How To Register For Texas Unemployment Tax

You can come back later to continue the registration process.

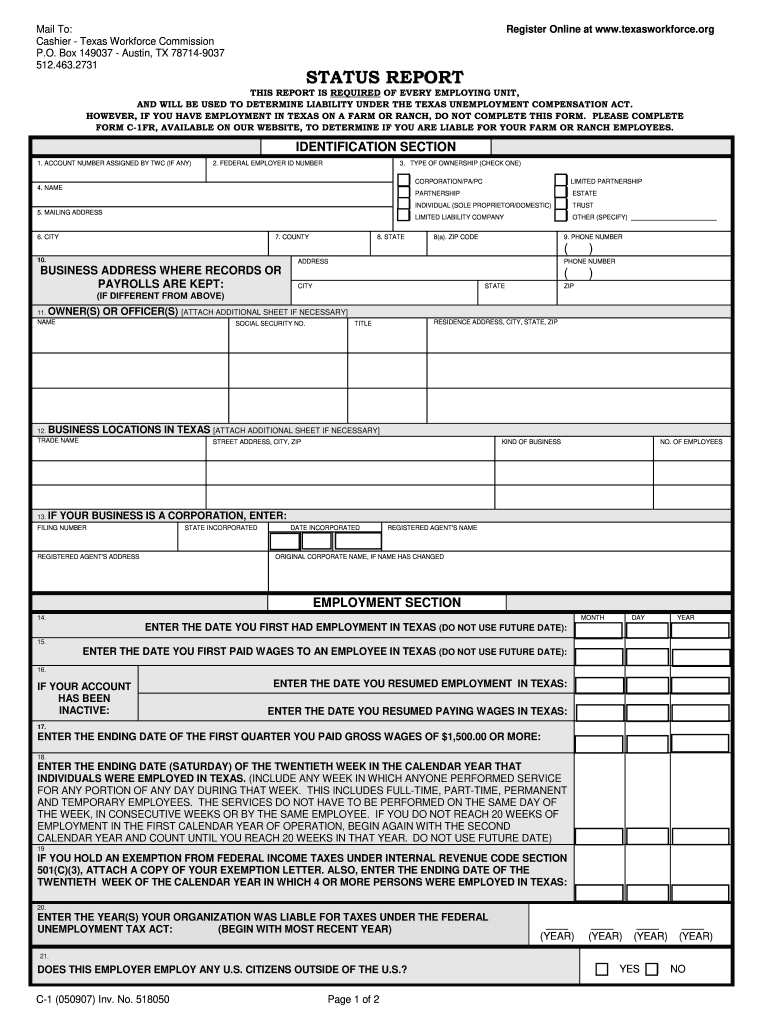

How to register for texas unemployment tax. Who is a liable employer. Employers who are subject to rules outlined in tuca are liable to pay unemployment taxes and include any of the following. Once wages are paid employers should register with the texas workforce commission twc within 10 days of becoming liable for texas unemployment tax. Complete your unemployment tax registration. Unemployment tax registration help regular employment close this window.

Incomplete registrations will be accessible through this internet site for one year. A texas unemployment insurance tax registration can only be obtained through an authorized government agency. Depending on the type of business where you re doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a texas unemployment insurance tax registration. You will need to apply using form ap 201 texas application pdf. Once wages are paid employers should register with the texas workforce commission twc within 10 days of becoming liable for texas unemployment tax.

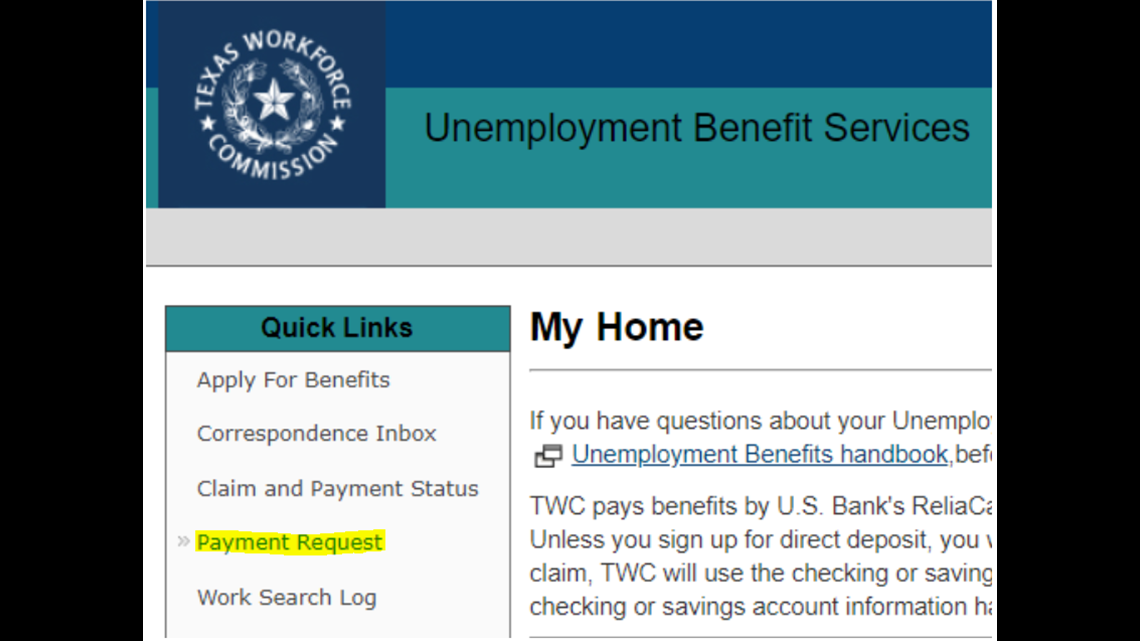

The system will automatically save partial registration information once the initial details have been entered. Sole owner s social security number. Under texas state rule usage may be subject to security testing and monitoring applicable privacy provisions and criminal prosecution for misuse or unauthorized use texas workforce commission collects personal information entered into electronic forms on this internet site. Once the registration is complete liable employers will receive a twc tax account number and may be able to file wage reports and submit unemployment tax payments online. For more information see determine whether you need to establish an unemployment tax account.

Information entered in this system will be used to determine liability under the texas unemployment compensation act. As a texas employer subject to ui tax your small business must register with the texas workforce commission twc so you can obtain a twc tax account number. To register online go to the unemployment tax registration section of the twc website. The process should take about twenty minutes. For more information on your rights to request review and correct information submitted on this electronic form.

Overview this page collects regular employment information. The twc prefers that you register online but you can also register by mail. Email the application to sales applications cpa texas gov or fax the application to 512 936 0010. You will receive a twc unemployment tax account number upon completion. You must register with the twc within 10 days of becoming liable for ui tax.